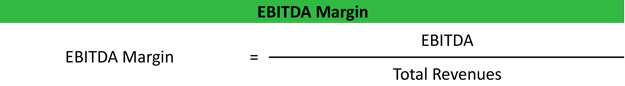

Ebitda margin formula

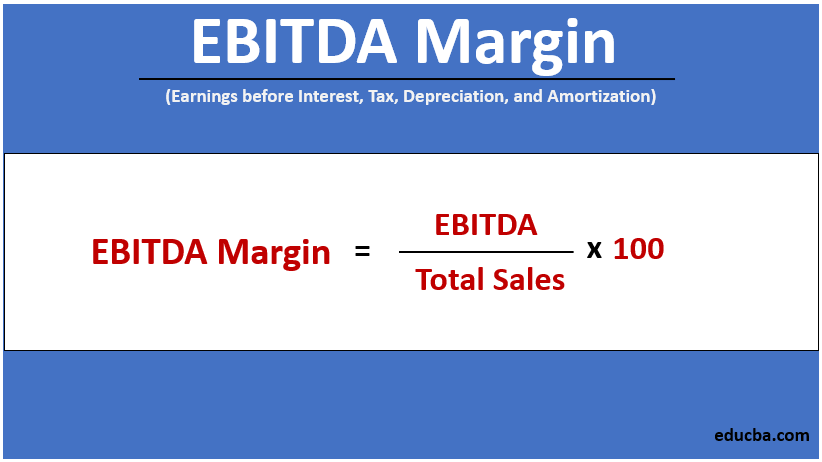

Firstly note the companys total annual sales. EBITDA margin EBITDA Net Sales.

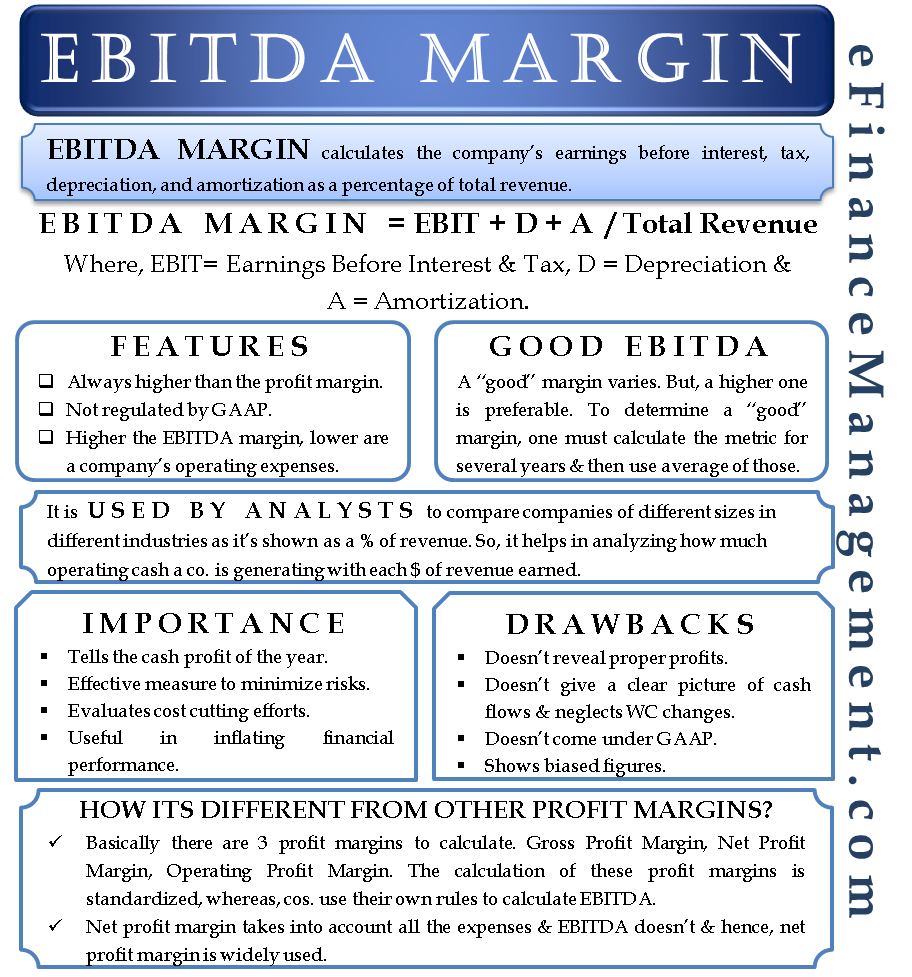

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

31555 523964.

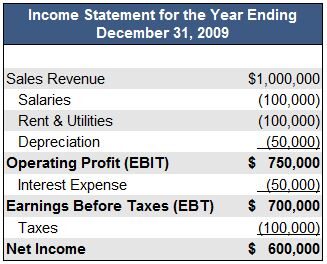

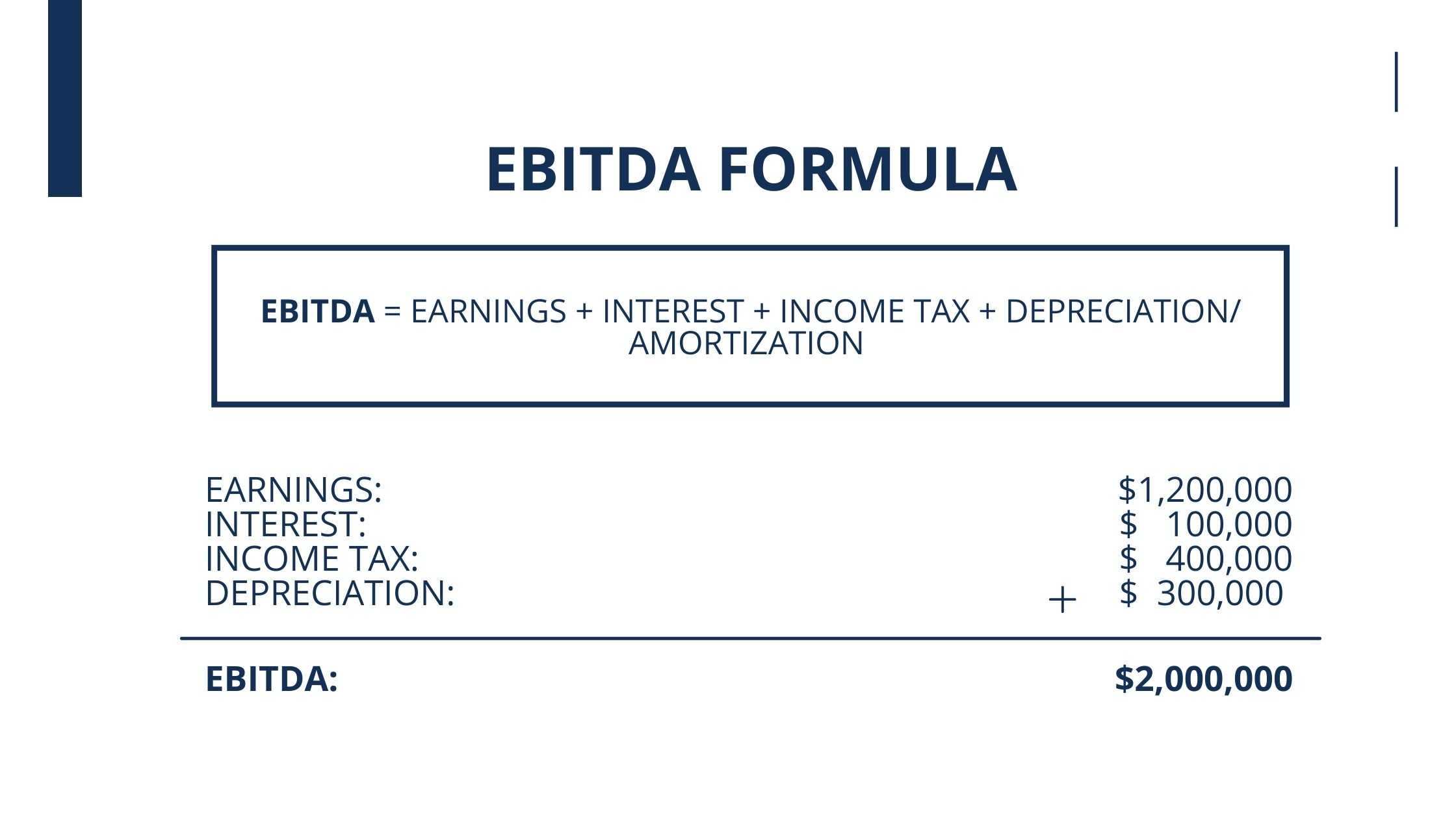

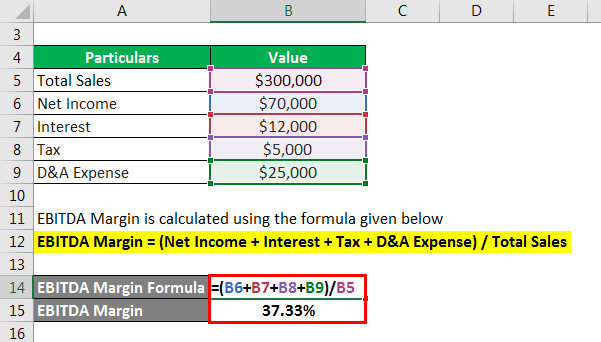

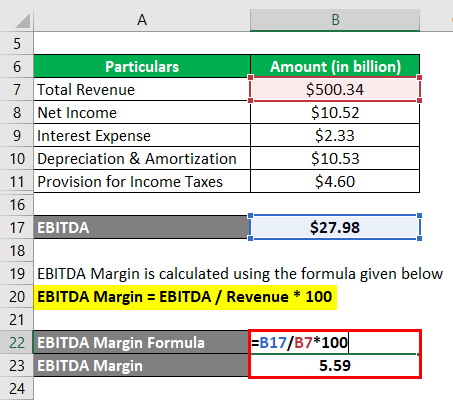

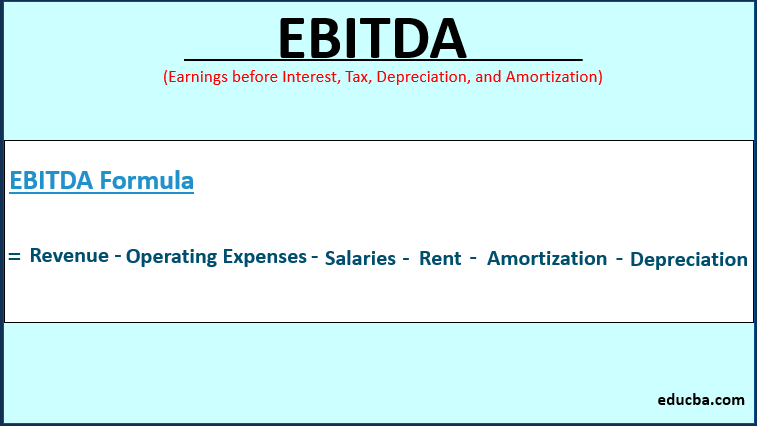

. Formula To calculate EBITDA margin. The EBITDA margin formula is reached by dividing EBITDA by total revenue to reveal the companys profitability. Here we discuss how it can be calculated by using a formula along with the Advantages and Limitations.

The EBITDA margin is EBITDA. EBITDA Margin Formula. Now take a simple example.

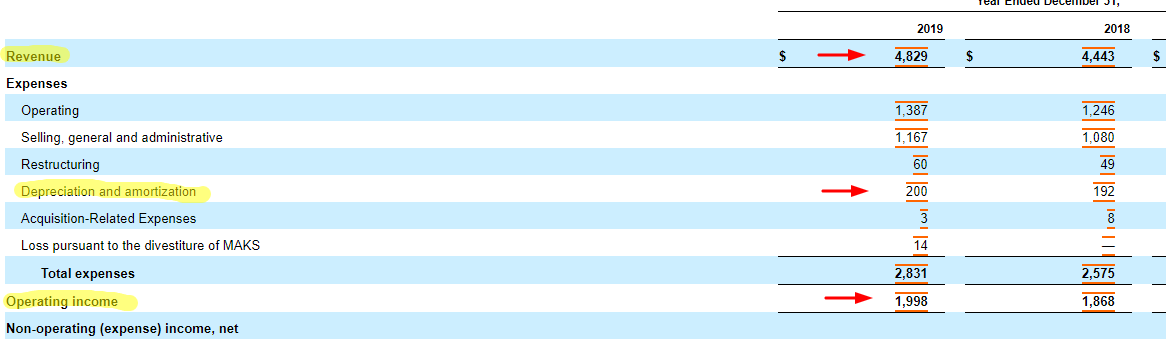

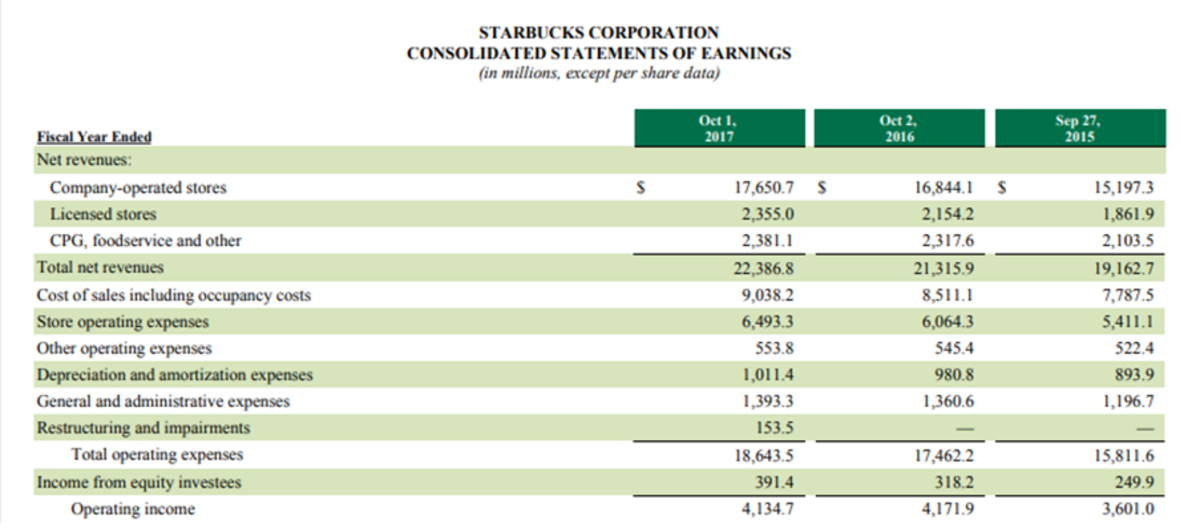

The EBITDA formula measures a companys profitability using items from the income statement. What is a good EBITDA margin. Next determine the COGS or.

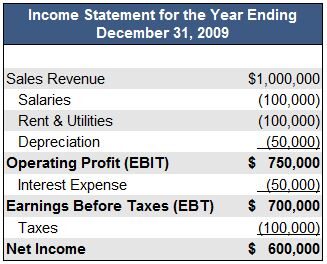

To explain the EBITDA formula take a look at Premier Manufacturings multi-step income statement. EBITDA Margin measures the difference between companys operating profit and revenue as a percentage. EBITDA Margin EBITDA Revenue.

Nevertheless the most common. A good EBITDA margin or valuation metric will depend on the industry. EBITDA Margin Formula EBITDA Margin EBITDA Revenue For instance suppose a company has generated the following results in a given period.

EBITDA Margin 40m 100m 400. It is equal to earnings before interest tax depreciation and. An EBITDA margin is similar to profit margin.

As evident from the calculation above Walmart earns a moderate EBITDA margin of only 6. What this means is. Suppose in 2016-17 the company sales is 50 crores and expenses excluding interest tax and.

EBITDA is a profitability measure higher EBITDA also represents low operating. 3 hours agoWith Amazon EBITDA at 526 Billion and net income at 116 Billion in FY 2022 EBITDA is 448 X greater than net earnings. With TTM EPS at 112 a share EBITDA is 448.

EBITDA net income interest expenses tax depreciation amortization. EBITDA is calculated by taking sales revenue and deducting operating. A company posted revenue of 2 million and EBITDA of 200000.

But instead of calculating your total revenue that resulted in net profit it shows how much of your total revenue resulted in. Since EBITDA is a non-GAAP measure there is no consistent set of rules dictating the specific items that belong in the metric. The EBITDA margin is usually a percentage found using the.

Analysis of EBITDA margin. The formula for the EBITDA margin can be calculated using the second method is. Guide to the EBITDA Margin.

The EBITDA formula is. Applying the formula is as follows we calculate. Here is the formula.

A high EBITDA percentage means your company has less operating expenses and higher earnings which shows that you can pay your operating costs and still have a decent amount of. EBITDA margin is a measurement of a companys operating profitability as a percentage of its total revenue. The operating margin and net income margin of the companies are impacted by their different.

EBITDA margin represents how much cash profit a business generates from operations out of one.

Ebitda Margin Features Importance Drawbacks Other Profit Margins

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

Your Ebitda Margin Guide How To Use The Controversy Real Examples

Ebitda Margin Formula Meaning Interpretation With Examples

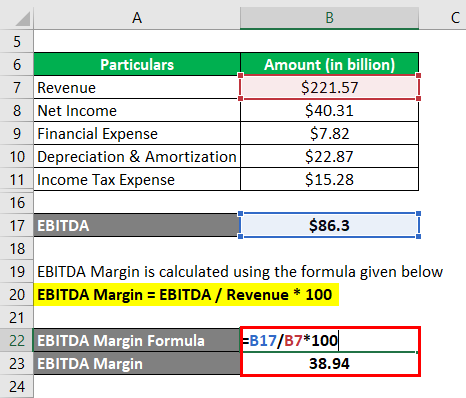

Ebitda Margin Formula And Calculator Excel Template

Ebitda Margin Definition Example Investinganswers

How To Calculate Ebitda Margin

What Is Ebitda Formula Example Margin Calculation Explanation

Ebitda Margin Template Download Free Excel Template

Ebitda Margin Formula And Calculator Excel Template

Ebitda Margins What Every Small Company Owner Needs To Know

How Do I Calculate An Ebitda Margin Using Excel

What Is Ebitda Formula Example Margin Calculation Explanation

What Is An Ebitda Margin Examples And How To Calculate Thestreet

Ebitda Margin Formula Example And Calculator With Excel Template

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

Ebitda Types And Components Examples And Advantages Of Ebitda